starting credit score in india

Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number.

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

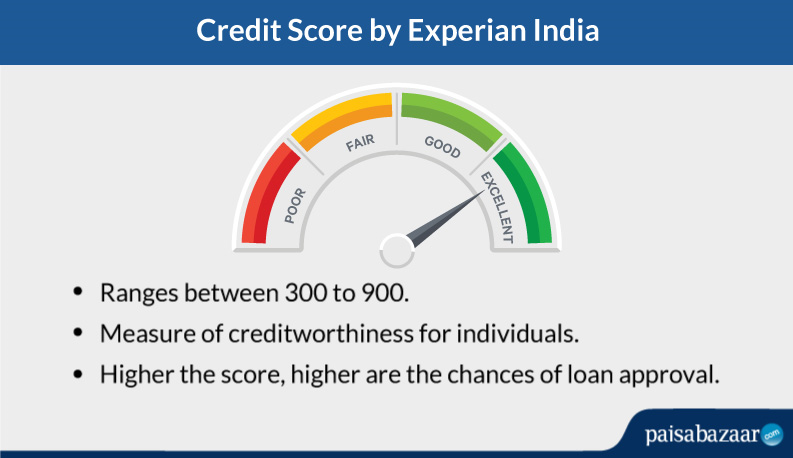

An individuals credit score plays an important role in determining hisher credit worthiness.

. These bureaus use their algorithms based on the following credit aspects to calculate your credit score in India. A higher value indicate lower credit risk and reduced probability of. You have to give yourself 6 months to a year for your repayment history to reflect as a credit score.

A good credit score is considered to be more than 750. The answer may surprise you. But to open the line of credit you need to build a credit history the right way.

A good credit score is a key to get a wide spectrum of credit cards and quick loan approvals. If youre ready for your first credit card it may help you get started. Both in India and abroad.

A credit score is a three-digit number that represents the creditworthiness of an individual. The CreditVision NTC Score developed by TransUnion CIBIL gives a score of 101-200. How to Start a Credit Score.

CIBIL stands for TransUnion CIBIL Limited an Indian company that has access to your credit information. You should keep in mind that lenders consider 780 Experian Credit Score and 750 CIBIL Credit Score to be a good score. If it makes sense for you you might want to consider applying for a card with no annual fee.

Building a credit history will start you on your way to having a credit score. Offer you a credit card once you have opened a fixed deposit FD with them. Here we explained about what is good credit score in India and cibil score check.

The words CIBIL score are often used synonymously with credit score and refer to a three-digit score between 300 and 900. The startup is leveraging alternative data AI and machine learning to provide credit for the underserved. High Credit Score Affordable Loans.

Parameters That Credit Bureaus Use to Calculate Your Credit Score. Its products are supporting a big share of the salaried and self-employed population to become noticeable to lenders by making it viable for banks and NBFCs to underwrite. Ic ustomers must be over 18 years of age iit hey should be earning Rs.

Learn more about credit score checking and check credit score for free with Tata Capital. Hence it is always recommended that you must maintain a credit score of 750 and above in order to avail a loan without any problems. Do you begin at a the highest possible credit score b the lowest or c somewhere in between.

CreditVidya is one of the leading players in the alternative credit scoring space in India. TransUnion CIBIL is one of the four credit bureaus generating reports related to credit scores in India. In reality everyone starts with no credit score at all.

A score above 750 is considered to be an excellent score. After 6 months however you will finally have a score. The higher the score the lower is your risk profile and easier for you to get a loan.

Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card. There are predominantly four credit bureaus TransUnion CIBIL Experian Equifax and CRIF High Mark operating in India. Age 21 to 70 must have a regular source of income should have a minimum credit score of 750.

AVAIL INTEREST RATE SUBVENTION STARTING AT 4. These models utilise several aspects of a borrowers credit history including repayment history credit utilisation ratio age of credit etc to assign the 3 digit credit score between 300 and 900. The score is derived using information from all past credit transactions and loans.

With a lower score you may not get a loan from a big bank but from a smaller bank or NBFC at a higher rate. Here are a few tips that will help you build a good credit history from start. You dont immediately have a credit score.

This is a good way of getting a credit card to build your credit score. Though the score ranges between 300 and 900 the average is 750. CIBIL Score is a 3 digit number extend between specified limits from 300 to 900.

Starting with no credit score doesnt mean your score is zero. 25 May 2021. Your us credit score also known as your fico score can range from 300 to 850 and most people have a credit score between 600 and 750.

The basic eligibility criteria across credit card providers are. 10000 per month if they are employed iii s elf-employed people should be earning at least Rs. What is considered a good credit score.

The more you score to achieve 900 the greater you get credit card approval process. Once you get your first credit card or loan etc. While a score between 300 and 549 is deemed to be poor anything from 550 to 700 is deemed to be fair.

This score will be based on those 6. 200 lakh per annum ive mployed applicants cannot apply for a credit card if they are above 60 or 65. Starting credit score in india.

It typically ranges between 300 and 900 900 being the highest score possible. Indias 4 credit bureaus TransUnion CIBIL Equifax Experian and CRIF Highmark use different scoring models to calculate credit score. Banks and lending institutions check your credit score when you apply for a loan.

CIBIL scores range between 300 and 900. The closer the score is to 900 the better it is considered. If you get a credit card and start using it and pay the balance off every month which shouldnt be much then after 3 months your starting credit score of no record found will now be too new to rate.

Majority of those who get a loan have a score of 750 and above. Building credit through forms of credit. Its d none of the above.

Get a credit card against FD in a bank. The interest rate differential on a loan for someone with a credit score of 700 and 800 is estimated to be around 20-30 basis points bps. What is eligibility for a credit card.

Many banks in India like ICICI Bank Axis bank etc. Your Credit Score Doesnt Start at Zero. CIBIL Score is the credit score issued by CIBIL Indias first credit bureau and ranges between 300 to 900.

Your credit score.

Credit Score Credit Score Improve Credit Score Improve Credit

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

How To Improve Your Credit Score Forbes Advisor

How To Check Your Cibil Score For Free Online

How To Check Cibil Score Online Download Cibil Report

What Is Cibil Score Or Credit Score Best Tips 2021

How To Check Your Cibil Score For Free Online

All You Need To Know About Cibil Scores 2022

What Is A Good Credit Score And Tips To Maintain It Creditmantri

All You Need To Know About Cibil Scores 2022

How To Check Your Cibil Score For Free Online

Personal Loan For Low Cibil Score At Lowest Interest Rates

Goodcibilscore Depend On Your Credit History Better Your Credit History Higher The Cibil Score Improve Your Credit Score Credit Score Personal Loans

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

What Is A Good Credit Score Forbes Advisor

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

How To Check Your Cibil Score For Free Online

Cibil Score Full Form Meaning Login Registration Process

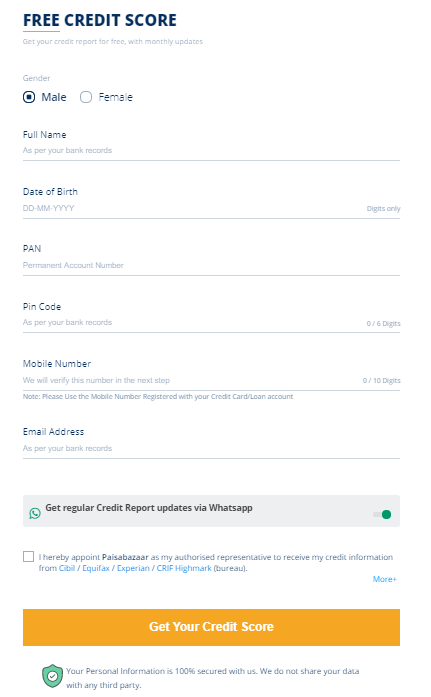

Free Credit Score Improvement Services In India Apply For Loans Credit Cards