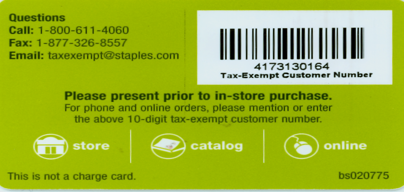

staples tax exempt certificate

Vendors name and certifi or both as shown hereon. You can call the hotline number for the customer and see if they have something but if it isnt there then there is a 2 week process they have to go through to get it set up.

Gift cards of any amount given to employees must be reported to the Tax Office for reporting on the employees Form W-2.

. Who do I contact. Ohio Sales Tax Exemption Certificate. Timeshare associations may qualify for tax-exempt status like other homeowners associations.

It allows your business to buy or rent property or services tax-free when the property or service is resold or re-rented. I dont care if they have paperwork from the state or US government if Staples doesnt have them on record for tax exempt then they arent getting it. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

Faxing it to us at 1-800-567-2260. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Staples Tax Exempt Certificate. Sales Tax Exempt Certificate - Staples.

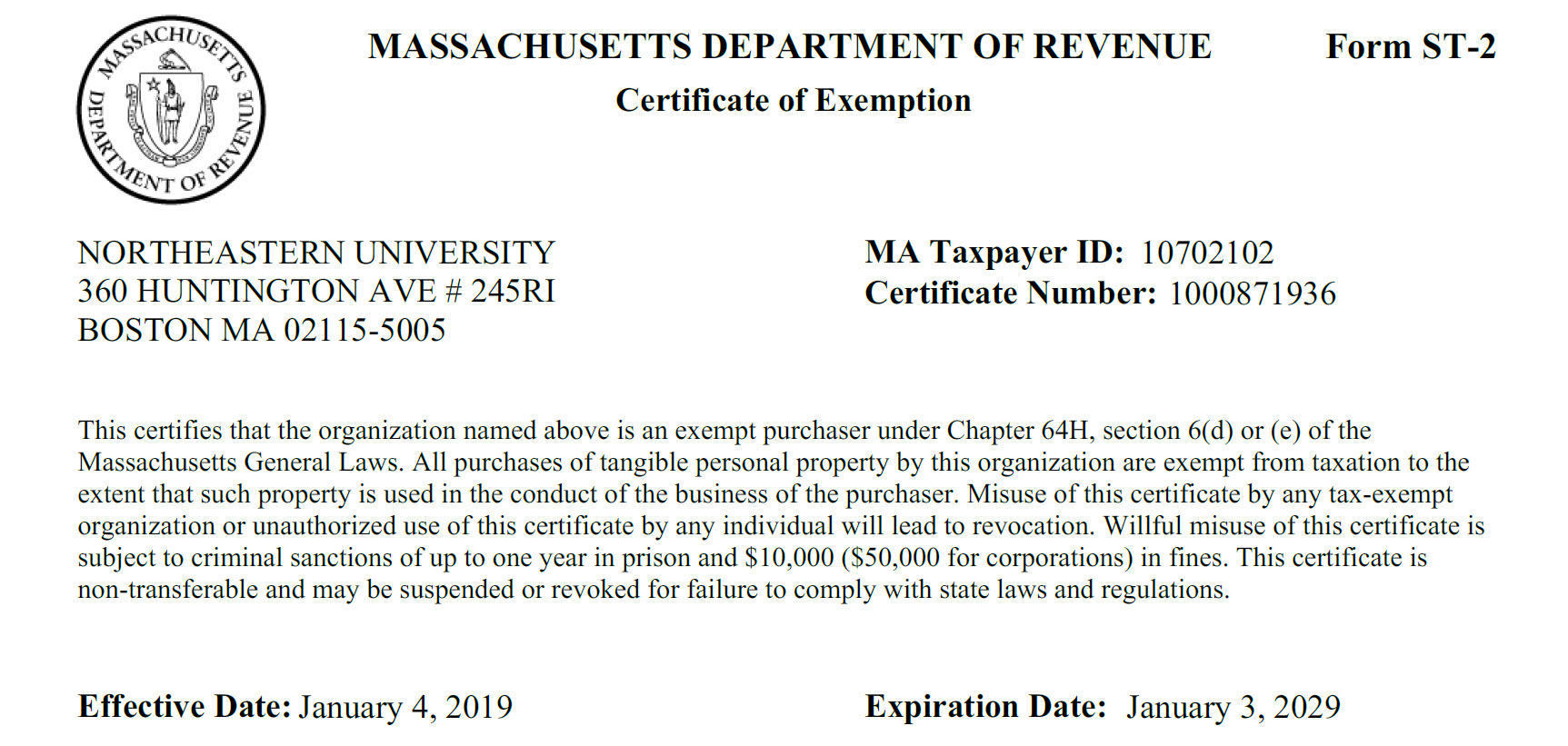

Government-issued Tax Exemption Certificate. Sales Tax Exemption Certificates. Full List of Resources.

Sales and Use Tax Blanket Exemption Certificate. Do not use this form for claiming an exemption on the registration of a vehicle. If you have already registered with Staples Advantage and have received your logon information you do not need to fill out the registration form below.

Fax your tax certificate to Staples at 888-823-8503. Send us your tax exemption certificate using either of the 3 following methods. In most states the sales tax is designed to be paid by the end-consumer of taxable goods or services.

And certificate of winding up if necessary certificate of withdrawal or certificate of surrender is filed with the California SOS. THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID. When setting up tax exemption you will need to provide.

Staples tax exempt certificate Wednesday February 23 2022 Edit. Obtain Staples Tax-exempt Customer number by following this procedure. PENNSYLVANIA TAX UNIT EXEMPTION CERTIFICATE USE FOR ONE TRANSACTION PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE USE FOR MULTIPLE TRANSACTIONS Name of Seller Vendor or Lessor.

Fax your tax certificate to Staples at 888-823-8503. Up to 5 cash back If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic. Tax exemption certificates last for one year in Alabama and Indiana.

Staples Tax Exempt Certificate. When setting up tax exemption you will need to provide. Sales Tax Exempt Certificate - Staples.

On a cover sheet please include your telephone number and order number if. Purchaser must state a valid reason for claiming exception or exemption. A sales tax certificate may also be called a resale certificate resellers permit resellers license or a tax-exempt certificate depending on your state.

You can go directly to the login page and begin ordering. Your company contact information. March 26 2010 Introduction Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax.

Please forward your tax exempt certificate to. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. If you are Tax Exempt.

Opening a new request with us HERE. If you have not registered with Staples. Send the completed certificate to the Comptroller of Public Accounts.

The purchaser fills out the certificate and gives it to the seller. A sales tax certificate is for exemption from sales tax you. How to use sales tax exemption certificates in South Carolina.

Tax reporting requirements and Account Codes for Gift Cards and Gift Certificates by recipient type. Download Sales Tax Exempt Certificate NetID login required Business Services has generated a UW-Madison Tax Exempt Status Letterdesigned to answer inquiries concerning our tax exempt status. Manuals Guides and Procedures.

Exemption Certificates for Sales Tax Tax Bulletin ST-240 TB-ST-240 Printer-Friendly Version PDF Issue Date. Sellers are required to charge sales tax on all transactions subject to tax except when a jurisdictions rules allow for the sale to be made tax-exempt. I dont care if they have paperwork from the state or US government if Staples doesnt have them on record for tax exempt then they arent getting it.

Applying for Tax Exempt Status. Exemptions are based on the customer making the purchase and always require. In addition the payment is subject to federal and state income taxes.

As of January 5 2021 Form 1024-A applications for. Sales Tax Exempt Certificate. Florida Illinois Kansas Kentucky Maryland Nevada Pennsylvania South Dakota and Virginia.

This certificate should be furnished to the supplier. Sales and Use Tax Exemption Numbers or Tax Exempt Numbers do not exist. If you hold a tax exemption certificate in one of these states make sure you renew as required to avoid possible penalties.

To claim an exemption. Below is a link that you can follow to download the Universitys tax-exempt certificate. If you are purchasing goods that you intend to resell you can make purchases from your suppliers tax-free by acquiring the appropriate Sales Tax Exemption Certificate for your state.

If you are Tax Exempt. Sales Tax Exempt Certificate. Up to 5 cash back Tax Exemption - All retail store purchases made using a Registered P-Card will be charged sales tax unless the Company a provides a valid tax exemption certificate at time of purchase b previously provided a valid tax exemption certificate at Retail and is in the Host Based Tax Look-up Database or c the Company shows a valid Retail Tax Exempt ID.

Certificates last for five years in at least 9 states. This letter is used to.

Hyper Tough Plastic Staples 25 Pack 34363 Walmart Com

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Forms Office Of Finance Northeastern University

Inducement Resolution Rushton Place Llc Project

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet

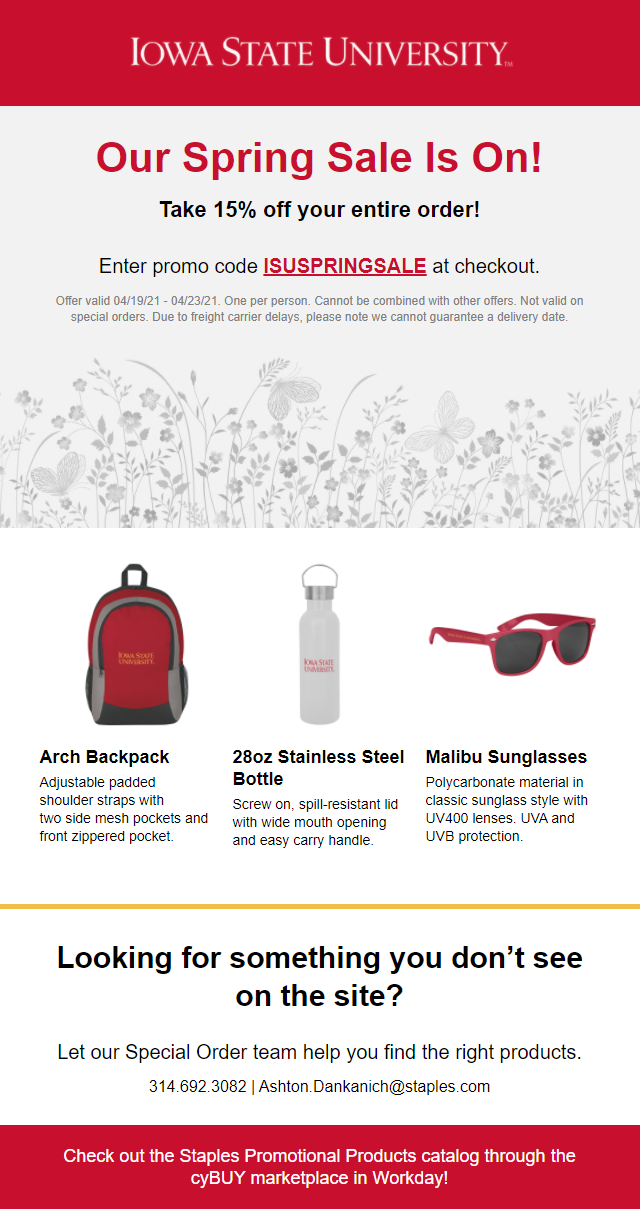

Staples Promotional Product Catalog Offer Procurement Services Iowa State University

Staples Com Customer Service Order Support

Staples Corrugated Boxes Legal Size White Gray 12 Carton 2489701 693172 Walmart Com