personal property tax relief richmond va

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Parking Violations Online Payment.

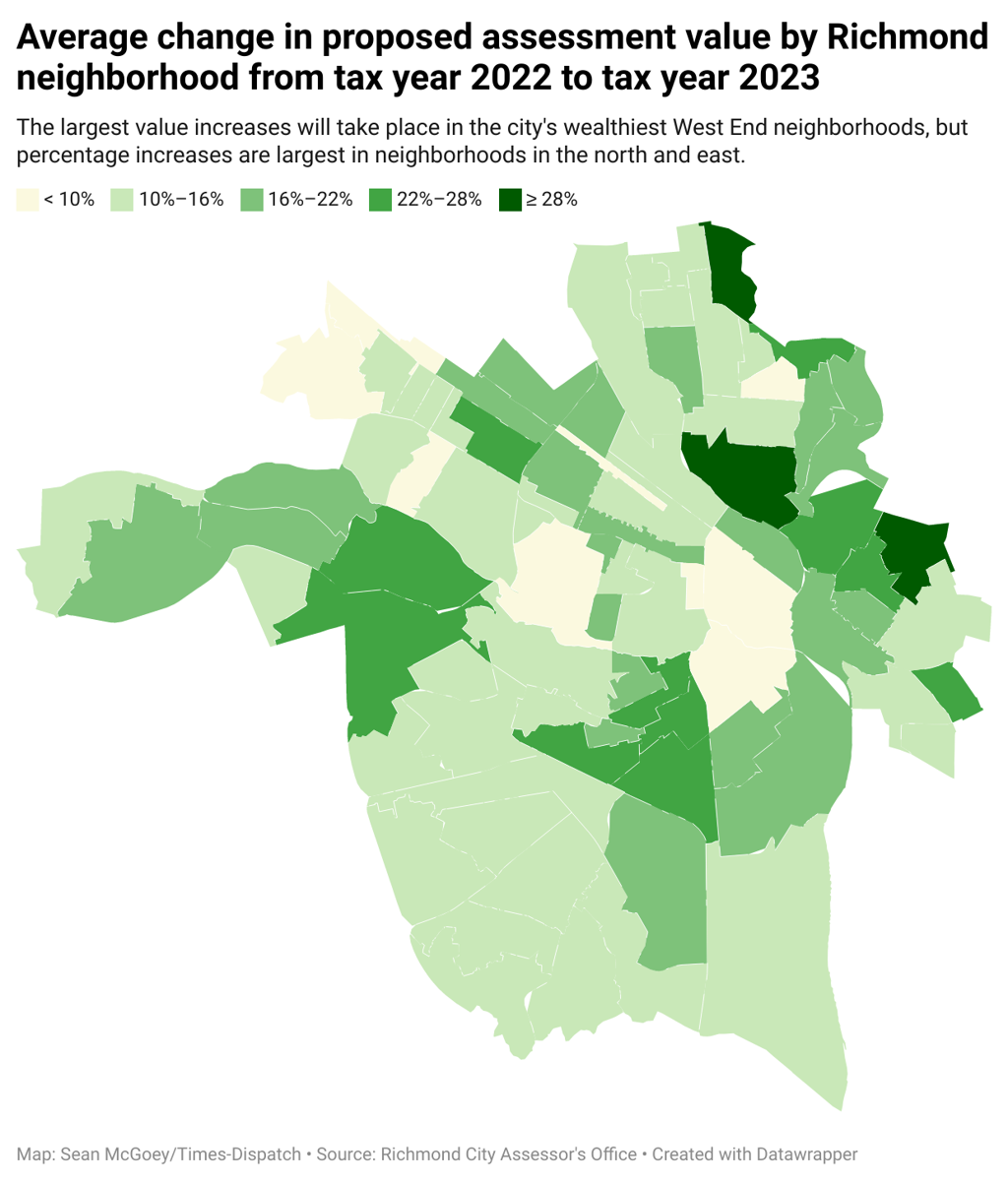

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Real Estate and Personal Property Taxes Online Payment.

. How is the personal. Personal Property Tax. The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle or pickup or panel truck having a registered gross weight of less than 7501.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. The City of Richmond has mailed personal property tax bills and are also available online. Broad Street Richmond VA 23219.

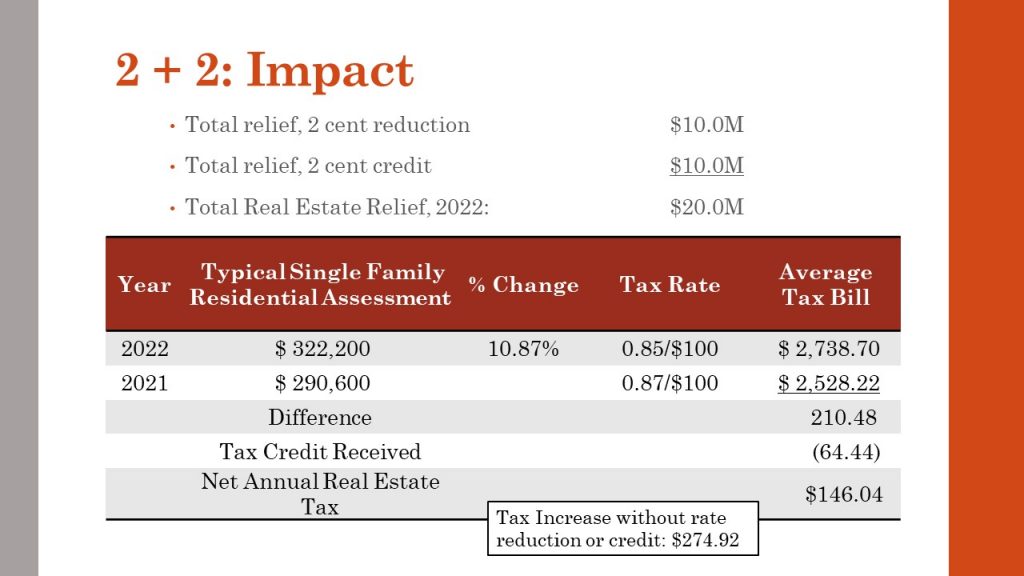

For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax. Tax relief partially or fully exempts residents from real estate taxes depending on their income and assets. 45 of the tax due on the first 20000 of assessed value.

Percentage of Tax Relief. Monday - Friday 8am - 5pm. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

On this page you will find announcements from the Department of Finance including important tax notices and more. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Broad Street Room 100 Richmond VA 23219 Phone 8046466015 Fax 8046465719 Email TaxReliefrvagov NOTE.

It was established in 2000 and is a member of the. The Personal Property Tax Unit manages Personal Property Tax Relief where applicable Tax Assessments and Tax Bills for Motor Vehicles Boats Trailers and. Electronic Check ACHEFT 095.

The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle or pickup or panel truck having a registered gross. Understanding that the past two. Box 27412 Richmond VA 23269.

Participants in the program can apply for tax relief or a tax freeze. Is more than 50 of. Taxpayers can either pay online by visiting.

Personal Property Tax Relief. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as. About the Company Personal Property Tax Relief Richmond Va CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Therefore the city has increased the amount of automatically applied Personal Property Tax also known as car tax Relief to offset our residents tax burden. Also for credit card payments. Please click on any of the announcement titles below to learn more.

The City of Richmond has two exemption options in addition to the Commonwealths Personal Property Tax Relief Act PPTRA which can be granted for motor vehicles. Tax returns are due on June 5 2022.

/do0bihdskp9dy.cloudfront.net/10-07-2022/t_2c283ae9bd8345b7a0fe85a7e0ad51c6_name_file_1280x720_2000_v3_1_.jpg)

We Want More People To Participate Richmond Encourages Homeowners To Apply For Real Estate Tax Relief Program

Gov Glenn Youngkin Signs Bill Aimed At Driving Down Virginians Car Tax Bills Wset

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Youngkin Proposes Nearly 400m In Tax Relief In Upcoming Budget 13newsnow Com

New Law Empowers Virginia Localities To Cut Vehicle Taxes Wset

Councilman Pushes For Tax Reform As Richmond Property Values Rise

2019 2020 Taxpayer Changes Virginia High Income Earners

News Flash Chesterfield County Va Civicengage

Raleigh County Assessor Serving All Of Raleigh County

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

How To Reduce Virginia Income Tax

Are There Any States With No Property Tax In 2022 Free Investor Guide

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Virginia Tax Legislation 2022 General Assembly

News Flash Chesterfield County Va Civicengage

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

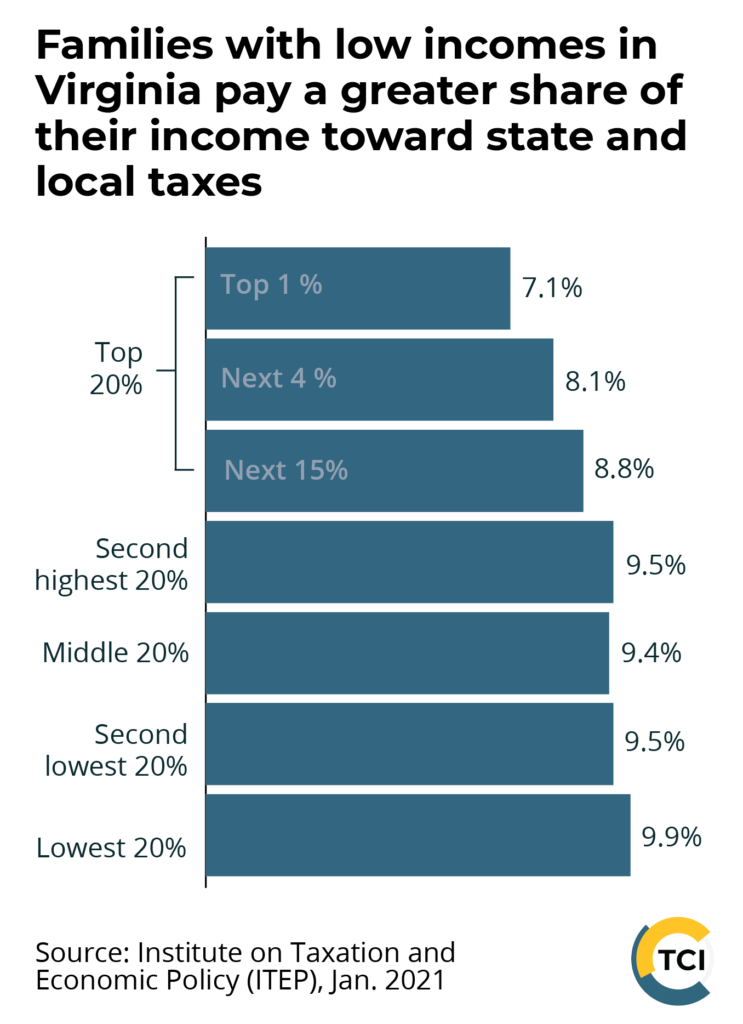

Youngkin Administration S Proposals Would Sharply Reduce State Resources Largely Exclude Working Families With The Lowest Incomes The Commonwealth Institute The Commonwealth Institute

/do0bihdskp9dy.cloudfront.net/10-11-2022/t_136c1ac6f6c64bdebc2b3e81174851c8_name_file_1280x720_2000_v3_1_.jpg)